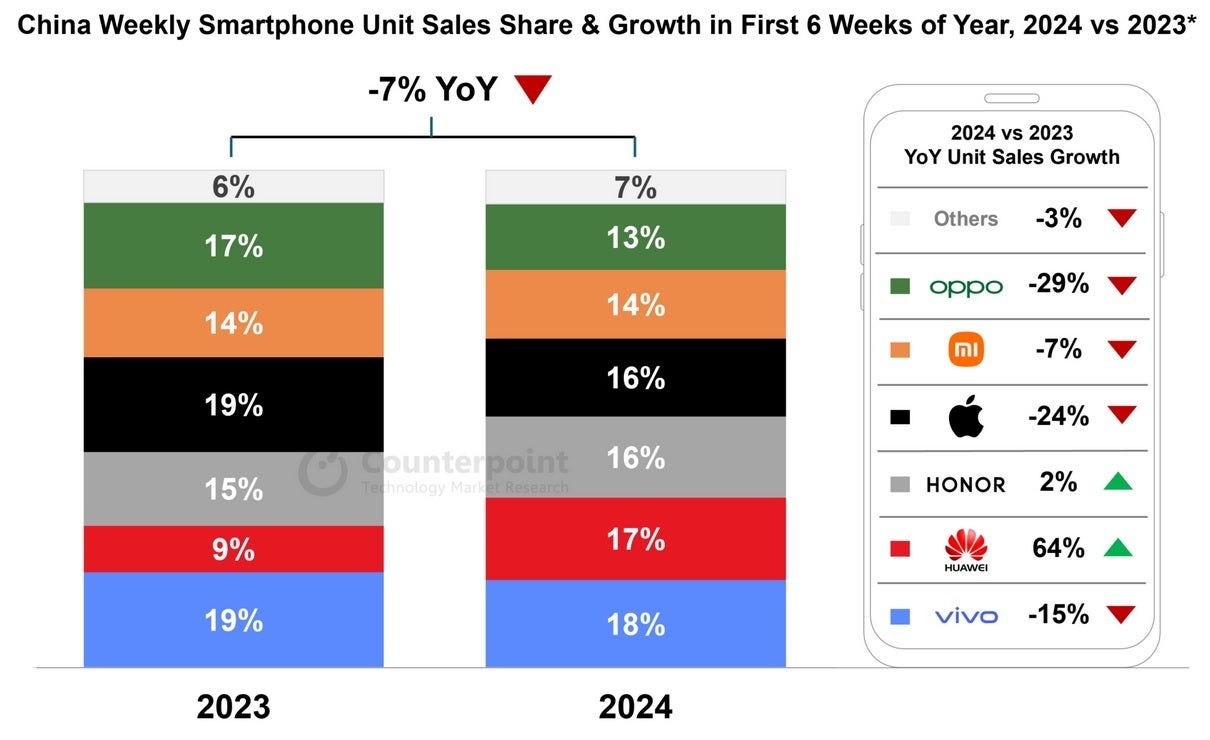

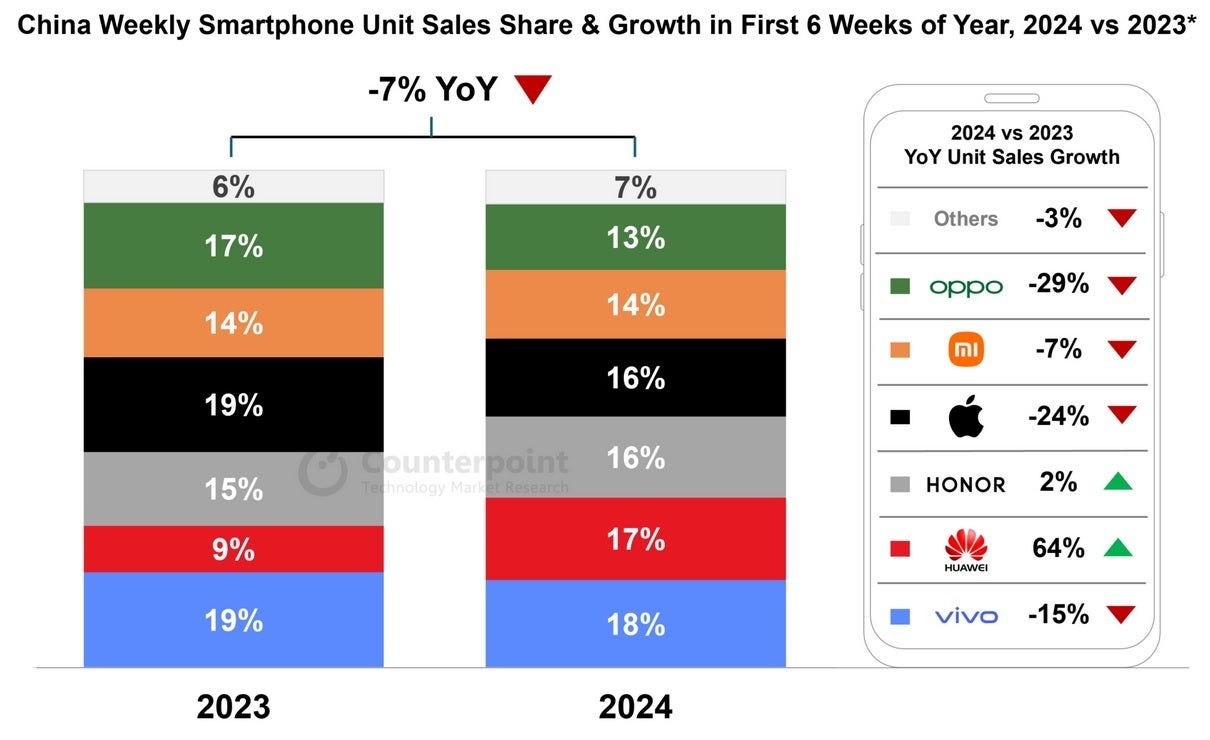

Consumers in the world’s largest smartphone market have spoken and after the first six weeks of 2024, iPhone sales have plunged 24% in China year-over-year. Counterpoint Research explains that an unusually strong January 2023 along with tough competition is responsible for the huge decline. Part of that competition comes from a resurgent Huawei which is still riding the stunning success of the Mate 60 series.

Announced last August, the Mate 60 line is powered by the first 5G Kirin chip produced for Huawei since 2020 when U.S. export rules were put in place. These rules prevent foundries using American technology from shipping cutting-edge chips to Huawei. As a result, Huawei’s previous flagship lines like the P50, Mate 50, and P60 were powered by Snapdragon chips that Huawei received a license to obtain; however, these chips were modified so as not to work with 5G networks.

As you might have expected, Huawei’s introduction of the 5G Mate 60 line electrified Chinese phone buyers and Huawei saw its sales soar 64% during the first six weeks of this year compared to the first six weeks of last year.

Huawei continues to gain momentum thanks to the stunning release of the 5G Mate 60 line

Overall, smartphone sales in China declined 7% on an annual basis during the first six weeks of the year. Vivo was the top phone manufacturer in China for the first six weeks of 2024 with 18% of the market. That was steady with the 19% market share it held last year at the same time even though sales declined 15% during the 2024 period compared with 2023. After the first month and a half last year, Vivo was tied with Apple at the top of China’s sales charts.

Huwaei’s market share soared from 9% after 2023’s first six weeks to 17%. It now finds itself trailing only Vivo in China after placing at number six a year ago. Apple and Honor tied for third, both with 16% of the Chinese phone market after six weeks. Last year after the same time, Apple was tied for first and Honor was in the middle of the pack. While Apple this year suffered through a 24% sales decline in China, Honor saw sales rise 2% year-over-year after six weeks.

Xiaomi’s first month and a half of the new year saw its sales in China drop 7% leaving it in fifth place with the same exact 14% share of China’s phone market that it had last year at the same time. Finishing in sixth place after a disastrous 29% sales decline to kick off the new year was Oppo. The latter, after six weeks, owned 13% of China’s smartphone market. That was down from the 17% share it had at the same period last year when it was third after Apple and Vivo first place tie.

China is the world’s largest smartphone market followed by India at number two and the U.S. is number three.

#Riding #years #stunning #announcement #Huawei #tops #Apple #China #weeks