Weak market, strong leader

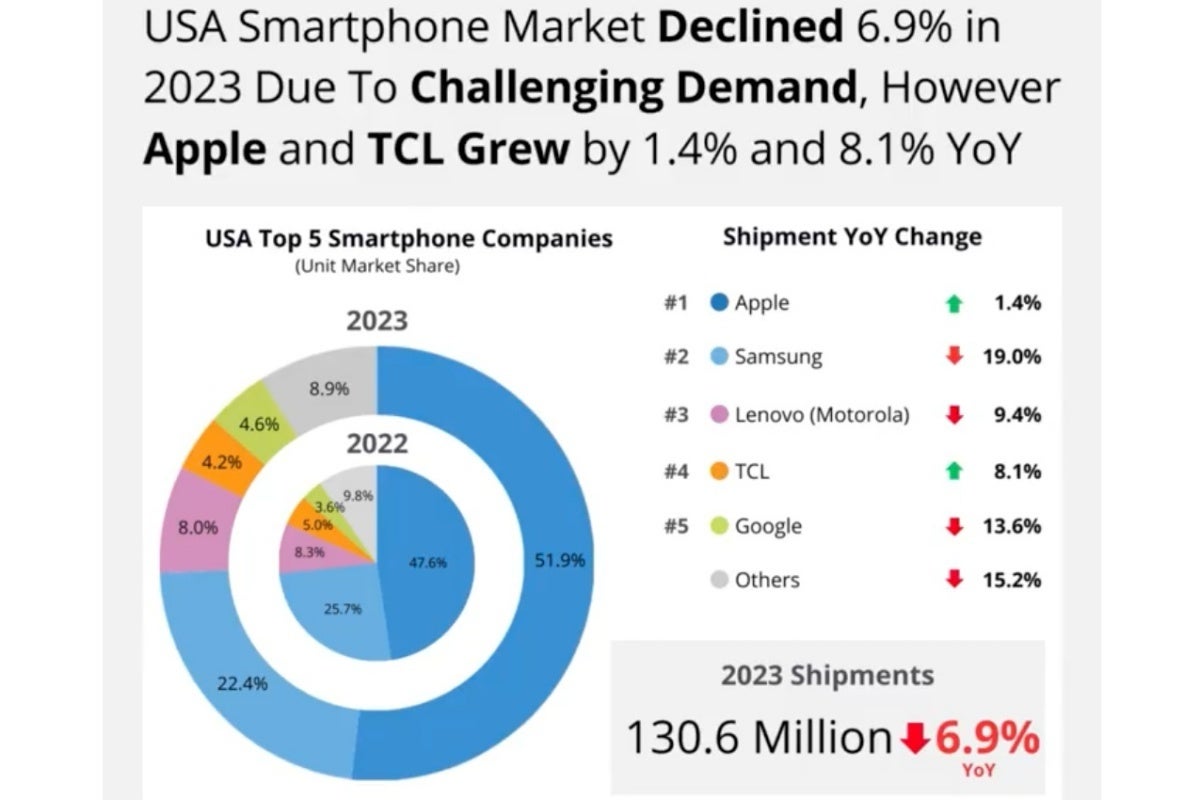

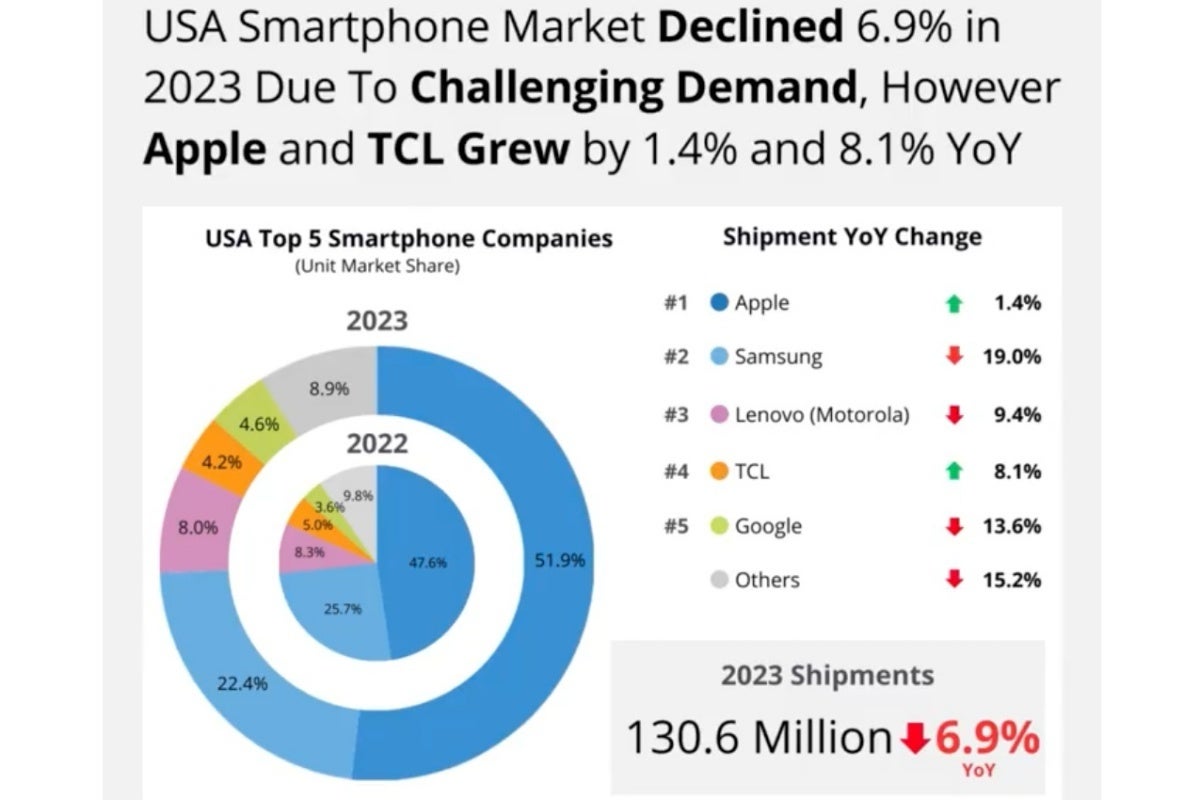

The market as a whole declined by 6.9 percent in 2023, mind you, ending the year with a tally of 130.6 million units, which only makes Apple’s achievement that much more remarkable. In second place, Samsung dropped a staggering 19 percent compared to 2022 as far as shipments are concerned, which naturally caused a dip in the company’s market share as well from 25.7 to 22.4 percent.

Can you guess the name of that rising vendor? No, it’s actually not Google, Motorola, or OnePlus but rather TCL. The China-based tech giant behind a lot of ultra-low-cost handsets available in the unlocked channel, as well as from prepaid carriers, gained a cool 8.1 percent in shipments last year.

Oddly enough, the International Data Corporation (IDC) is ranking TCL behind Google in the 2023 US vendor chart, which appears to be a typo. Google’s Pixels, meanwhile, are said to have declined in sales and jumped in market share, which doesn’t make a lot of sense.

Hello, Moto!

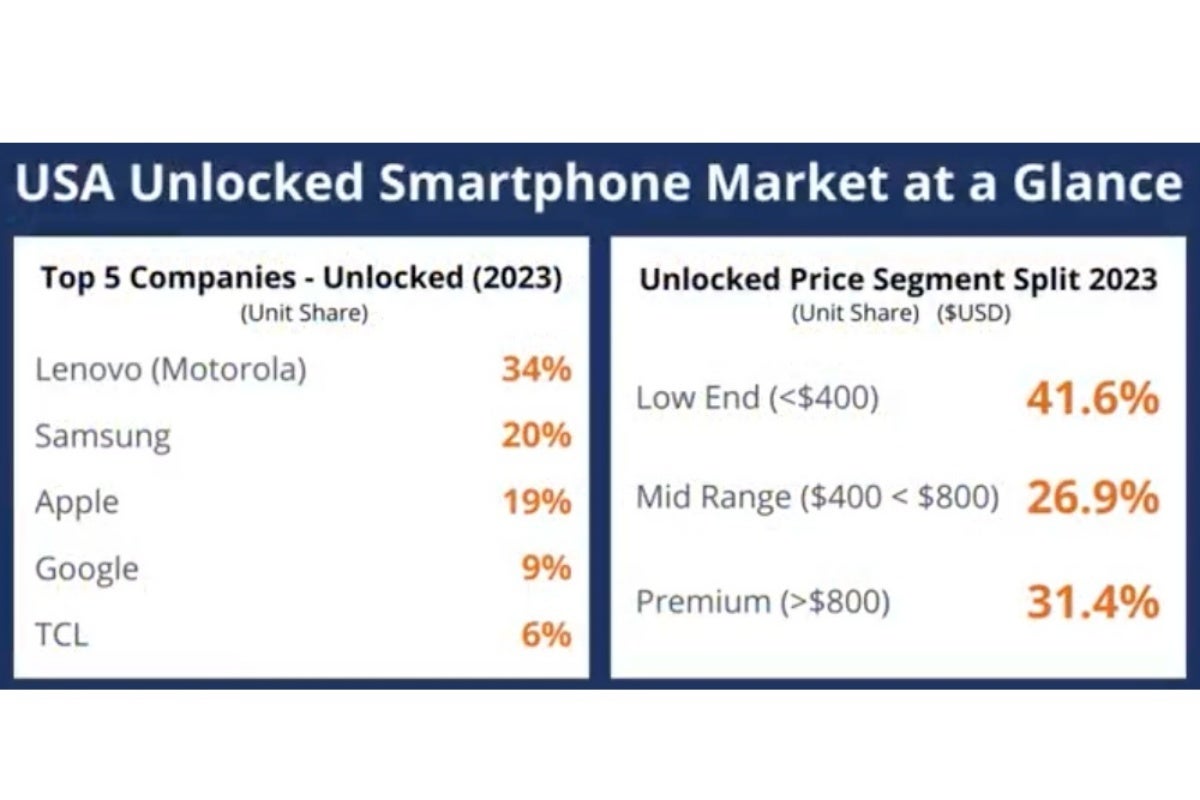

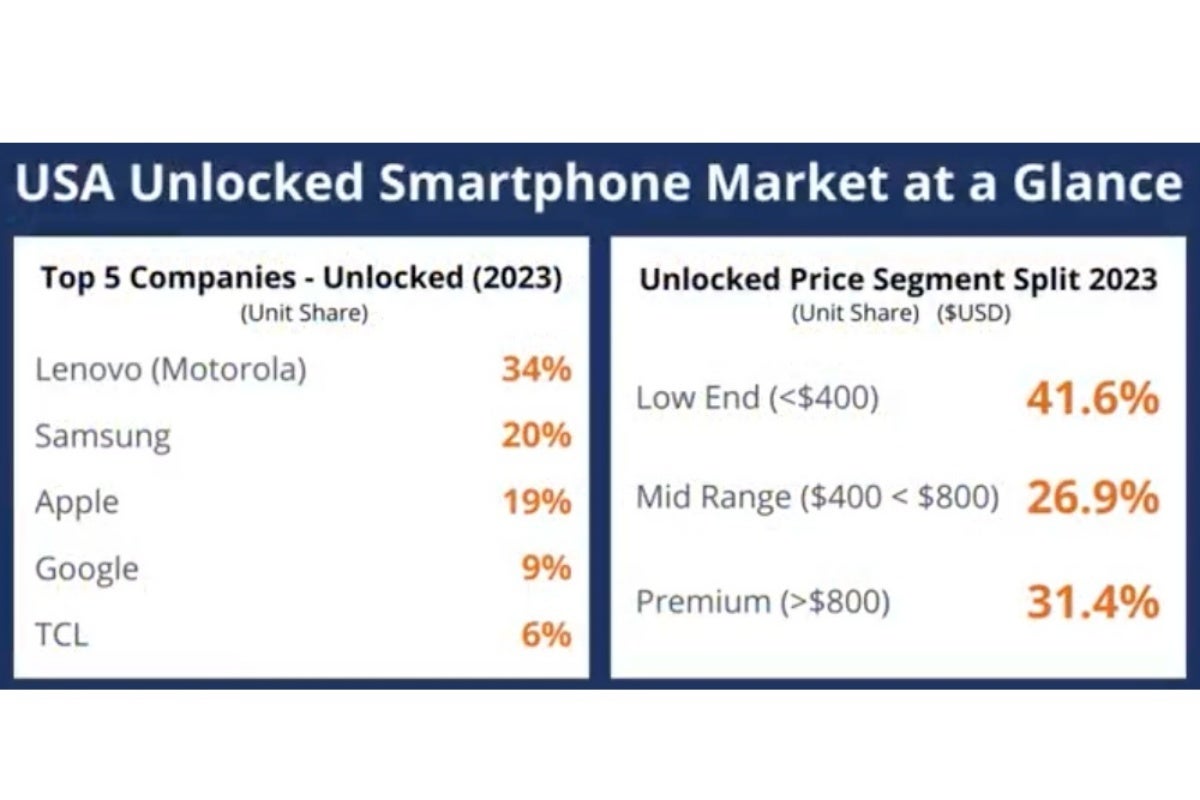

Clearly, Motorola is dominating a tiny piece of the market that Apple is probably not particularly interested in. Still, it’s… unusual to see any US smartphone chart led by an Android brand, with another Android brand occupying second place.

Another interesting but far from surprising aspect covered by this new IDC research is the significantly greater popularity of low-end models compared to “premium” phones as far as unlocked sales are concerned.

Premium devices priced above $800 are however more successful than mid-rangers typically available for anywhere between $400 and $800, which is definitely a good sign for the likes of Apple and Samsung and their overall (regional) profit margins.

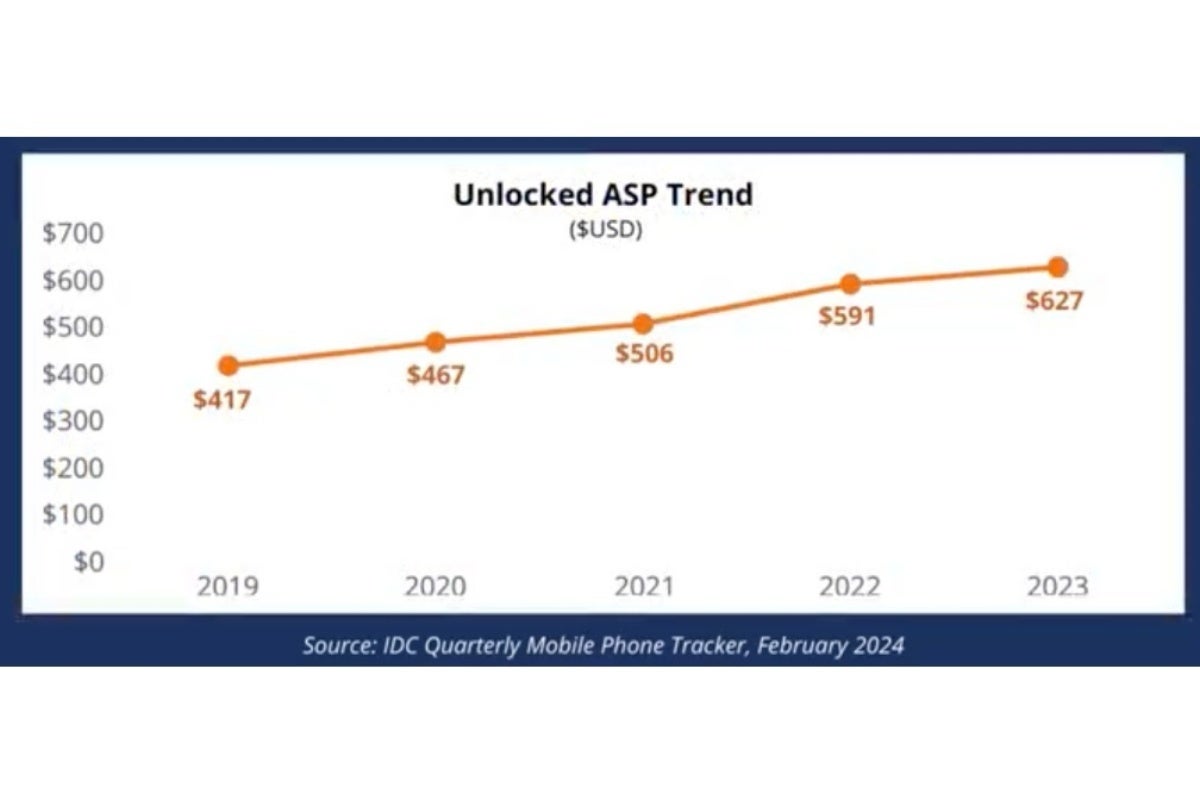

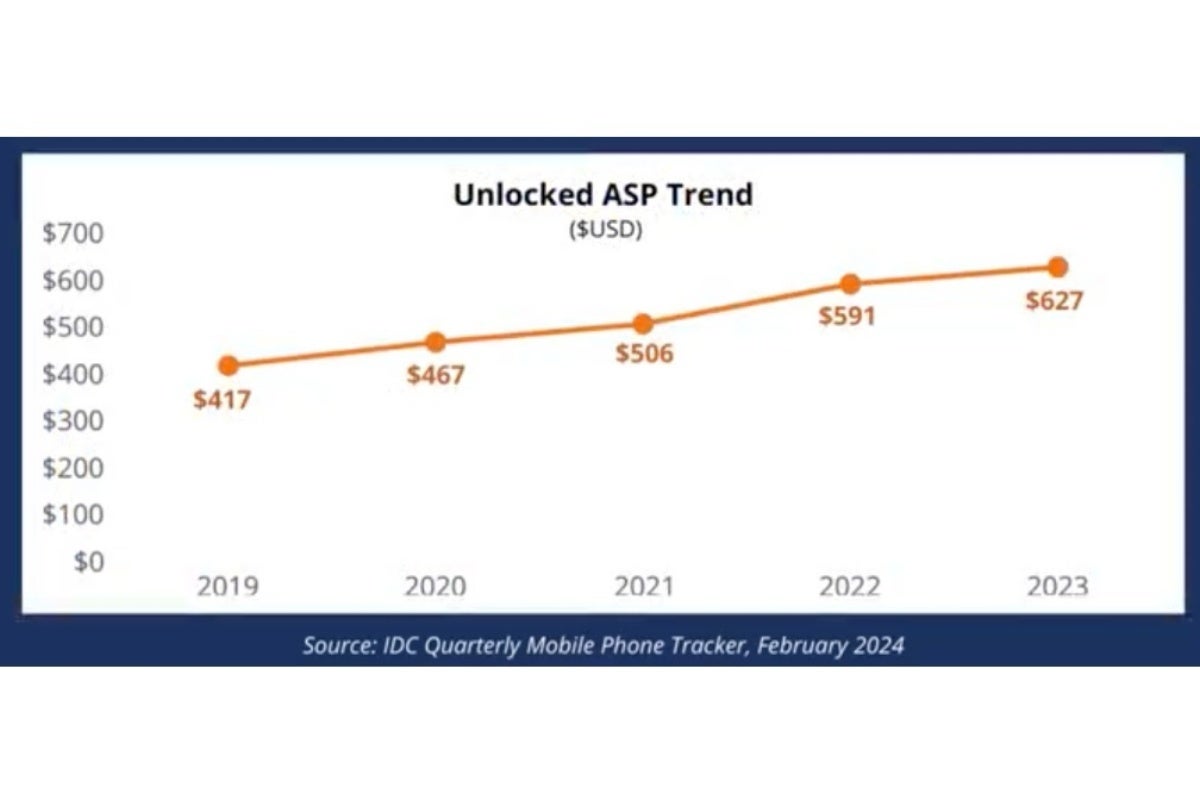

The region’s unlocked ASP (average selling price) has also risen steadily over the last four years, possibly due in part to the stronger and stronger performances of brands like Motorola, Google, and OnePlus in the high-end segment. The IDC is not making any predictions today on the future evolution of the US smartphone market, but like the global mobile industry, that was widely expected to stabilize and perhaps even return to (modest) growth this year.

#Apple #destroyed #rivals #unlocked #phone #segment #leader