The global smartphone market has a new old leader after Apple shocked the industry to take the annual world crown for the first time in 2023, and unsurprisingly, that means there’s a new old champion in Europe as well.

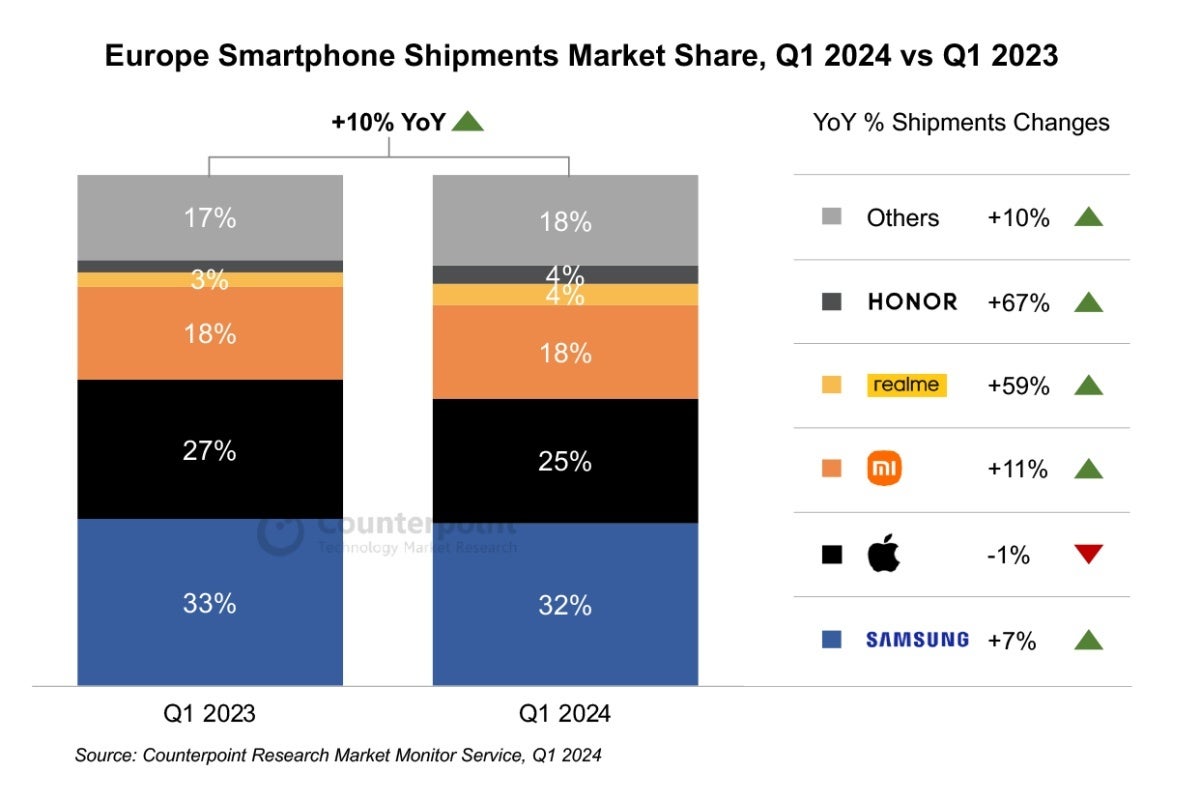

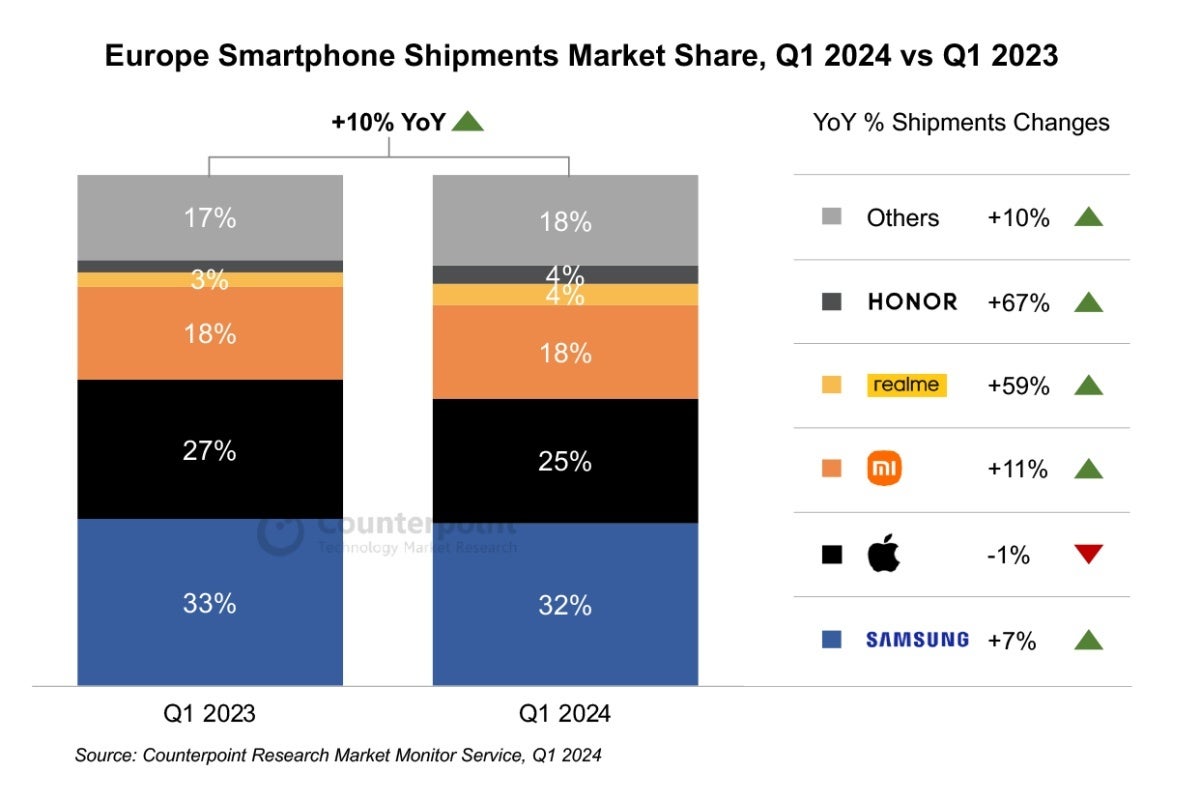

Following an October–December 2023 timeframe in which iPhones edged out Galaxy handsets on the old continent, Samsung managed to jump back in front of its arch-rival in the region between January and March of this year. This echoes the Korean tech giant’s European victory from Q1 2023, but Samsung’s advantage over Apple is up from six to seven percentage points.

The champ is up, the first runner-up is down

While that may not sound like a very significant change, with both Samsung and Apple’s market shares dropping from 33 and 27 percent respectively at the beginning of last year to 32 and 25 percent now, the evolution of the two’s regional shipment figures should definitely worry the Cupertino-based silver medalist.

That’s because Samsung’s European sales have risen by 7 percent between Q1 2023 and Q1 2024, while Apple slipped 1 percent in the same period and the same part of the world. Of course, that’s not really a substantial decline, but it comes at a time when the continent’s overall shipments surged by 10 percent year-on-year and all other top five vendors reported (bigger or smaller) number improvements of their own.

We’re talking a solid 11 percent bump for Xiaomi and absolutely mind-blowing 59 and 67 percent boosts in Realme and Honor’s shipment scores across Europe. The “others” category also made decent 10 percent year-on-year progress, despite the legal struggles of Oppo (including OnePlus), which used to be ranked in the region’s top five prior to this quarter.

Circling back to the heavyweight champion of the old continent (and the smartphone world in its entirety), we should point out that the “well-received” Galaxy S24 series predictably helped Samsung recoup its crown from Apple, while the mid-range Galaxy A35 and Galaxy A55 5G are expected to maintain and possibly even extend the gold medalist’s advantage over the vice-champion in Q2.

So what went wrong for Apple and right for (almost) everyone else?

One of the key reasons why Samsung made good progress in Q1 2024 in Europe and Apple failed to keep up is fairly predictable, having to do with the newness (and charm) of the aforementioned Galaxy S24 family and the “oldness” of the 2023-released iPhone 15 series.

The iPhone 15, 15 Plus, 15 Pro, and 15 Pro Max apparently continued to “tail off due to seasonality”, but that was actually not Apple’s only problem during the first three months of this year. Another flaw in the otherwise expansive iPhone portfolio remains the absence of a fourth-gen affordable SE model, which is unlikely to come out by the end of 2024, thus continuing to pose problems for the tech giant in many cost-conscious markets.

That’s where Xiaomi, Realme, and Honor currently excel with hugely popular Android mid-rangers like the Redmi Note 13, Realme C series, Honor 90, Magic V2, and Magic 6, which Apple simply cannot rival in terms of value for money. Tecno is another brand that’s managed to grow at an impressive pace recently, overtaking Apple in Eastern Europe and targeting a place among the entire continent’s top five vendors soon.

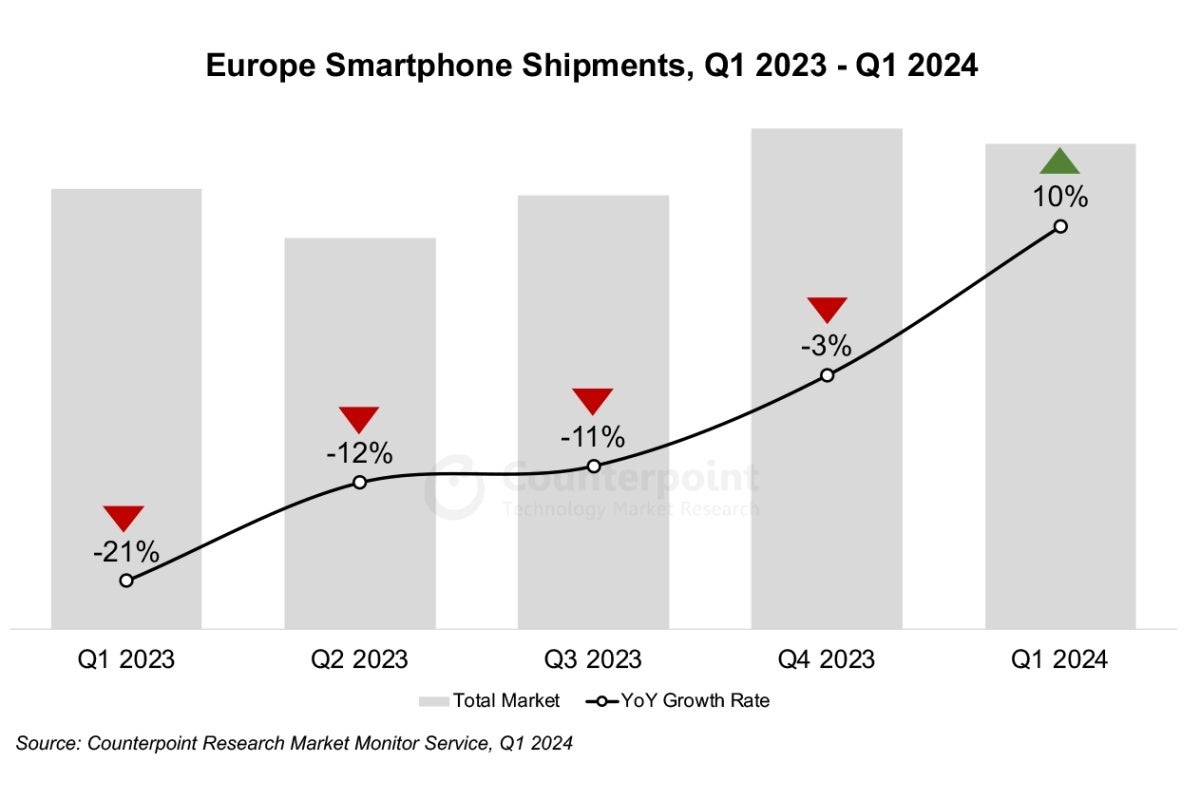

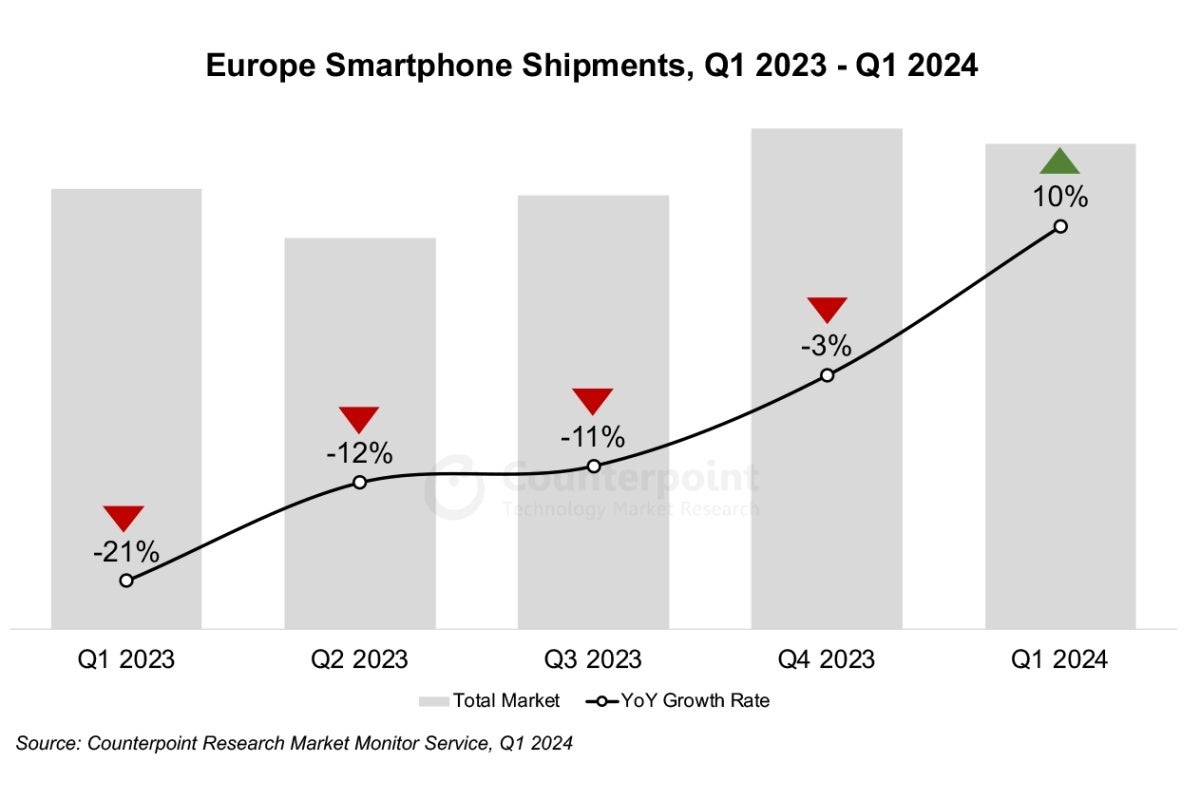

As for the European smartphone market as a whole, its 10 percent growth in Q1 2024 may sound remarkable (because it most definitely is), but it’s important to keep in mind that it comes on the back of a string of quarterly declines that started in Q3 2021. Sooner or later, that string had to end, but it doesn’t mean the market is healed now all of a sudden and ready to return to its pre-pandemic figures.

Instead, analysts expect “low single digit” progress for the rest of 2024, which is obviously better than seeing the market continue to shrink but it’s not enough to put smartphone manufacturers completely at ease.