Does Apple make the best smartwatches in the world? That’s an incredibly difficult question to answer without letting your brand loyalty cloud your objective judgment, but what’s not up for debate is that the Cupertino-based tech giant makes the best-

selling wearable devices out there.

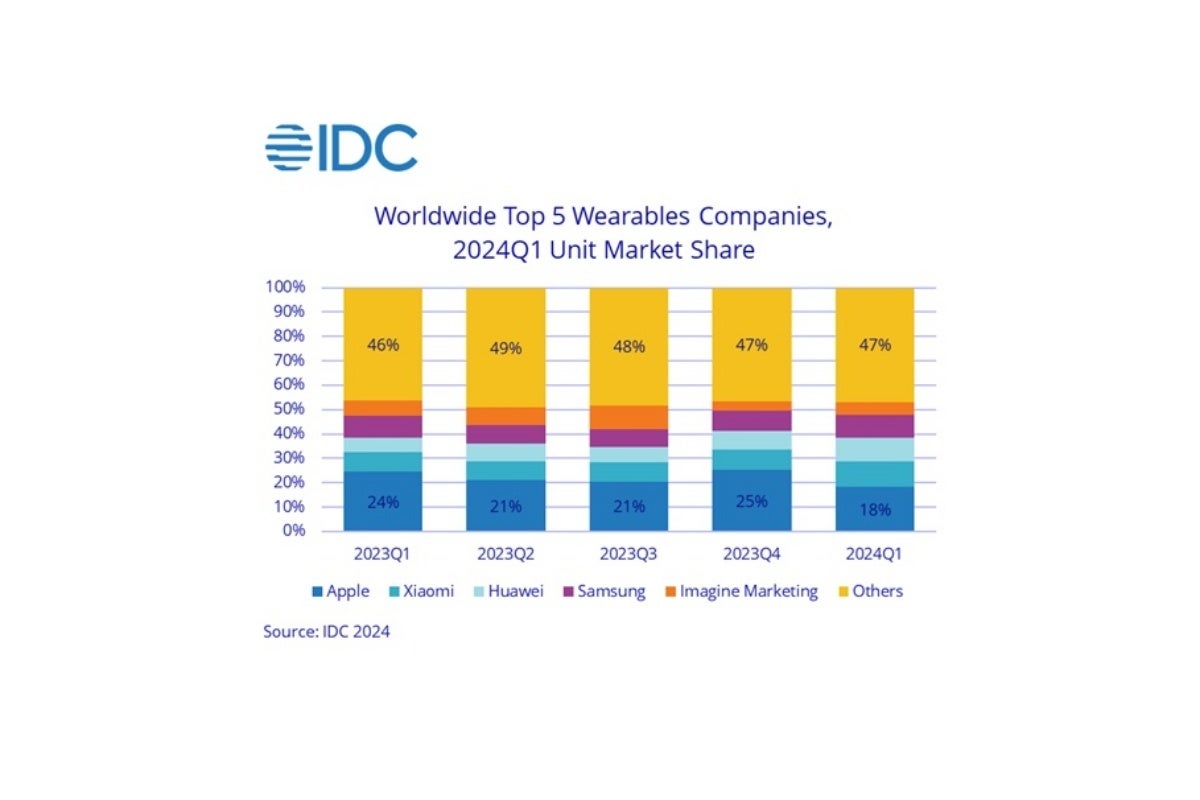

That’s been the case basically for as long as we can remember, but if the latest industry trends easily noticeable in the IDC (International Data Corporation)’s research continue for a few more quarters, the situation could well change, with Apple’s global supremacy being threatened from a number of directions.

What’s going on with Apple Watches and AirPods?

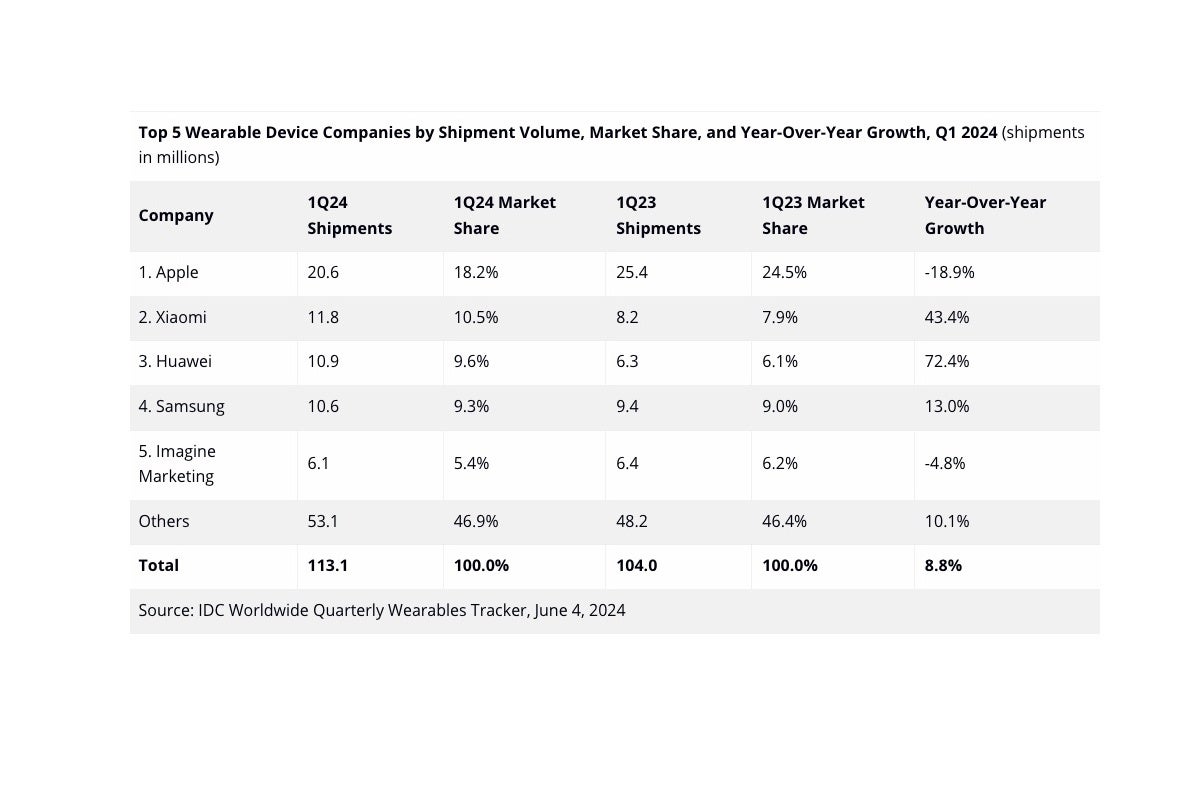

To be perfectly honest, we don’t exactly know. What we do know is that Apple’s wearable product portfolio dropped 18.9 percent in shipments between Q1 2023 and Q1 2024, which is a pretty woeful result. That’s made even worse by the fact that the market as a whole expanded in the same period by a solid 8.8 percent.

Xiaomi and Huawei were mainly responsible for this somewhat unexpected growth, with the industry’s silver and gold medalists posting quarterly sales improvements of 43.4 and 72.4 percent (!!!) year-on-year respectively. To put that in numbers you can understand more easily, Xiaomi sold 8.2 million wearables in the January-March 2023 timeframe and close to 12 million units a year later, while Huawei jumped from 6.3 all the way up to 10.9 mil between the opening quarters of last year and 2024.

Then you have the gold medalist behind the exceptionally well-reviewed Apple Watch Series 9 or AirPods Pro 2, which dipped from 25.4 million unit sales in Q1 2023 to 20.6 million in the January-March 2024 period. That was still enough for a commanding 18.2 percent market share, but the gap between the industry’s number one vendor and its main challengers is clearly getting narrower.

What’s truly concerning for Apple is that the company released two new smartwatches not so long ago, and while their names are not specifically mentioned in today’s IDC report, it’s pretty obvious that the “mainstream” Series 9 and rugged Apple Watch Ultra 2 are not selling as well as their forerunners, likely failing to meet the initial goals of their manufacturers as well.

The same probably goes for the AirPods Pro 2, AirPods 3, and AirPods 2, which do have the excuse of their more advanced age. But it’s likely their price points that are proving increasingly hard to swallow for wearable (or rather “hearable”) users around the world, which is why Apple should maybe consider releasing the long-rumored AirPods Lite ASAP.

What about Samsung?

Unlike its arch-rival, the Korean behemoth didn’t start the year with a terrible quarter. The first three months of 2024 were instead bittersweet for Galaxy Watches and Galaxy Buds, which surged in sales by 13 percent from Q1 2023 while losing their manufacturer’s number two spot on the global vendors’ podium.

Samsung didn’t even win bronze for Q1 2024, settling for a largely unchanged 9.3 percent market share as Xiaomi and Huawei spectacularly climbed up the ranks to finish the quarter behind Apple. “Lower-priced hearables” (presumably, the Galaxy Buds FE) and the new budget-friendly Galaxy Fit 3 wearable apparently helped Samsung achieve year-on-year sales growth, with the company’s “core smartwatches” (that’s the Galaxy Watch family) declining by around 5 percent.

That’s nothing compared to the 19.1 percent drop in shipments for the Apple Watch lineup, but it’s still a warning sign so soon after the Galaxy Watch 6 and Watch 6 Classic launch. This worrying trend might also explain why Samsung is seemingly planning to rehash the outdated (but still undeniably stylish) design of the Galaxy Watch 4 and release the first-ever Galaxy Watch FE edition sometime this year with a reportedly super-aggressive price point.

Ultra-affordable smartwatches and fitness trackers are clearly the main reason behind Xiaomi and Huawei’s incredible recent growth, but at the same time, those exact types of products proved far less popular for Imagine Marketing (aka boAt), which is a little Indian company that previously stunned the world with phenomenal sales increases of its own.

That seems to suggest “value-oriented” brands are generally subject to bigger fluctuations than Apple or Samsung, so it remains to be seen if Xiaomi and Huawei will be able to keep growing in the next few quarters and truly threaten Apple’s global industry supremacy.