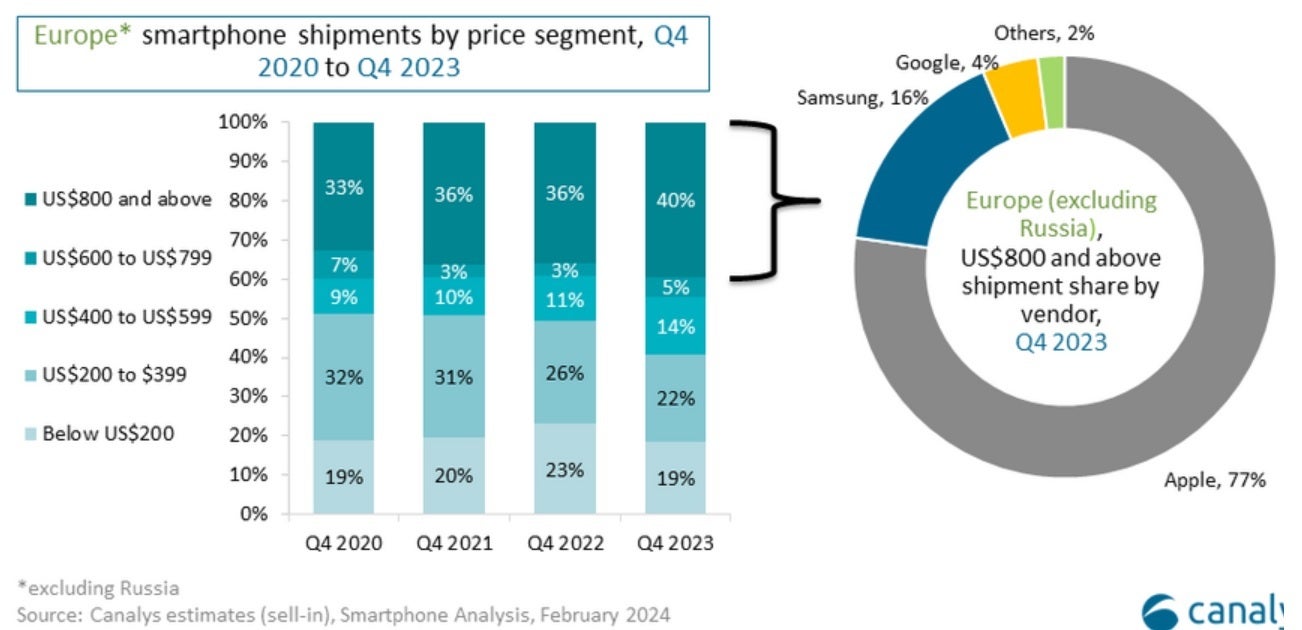

According to research firm Canalys, high-end smartphones had a record share of the European smartphone market during the fourth quarter of 2023. Close to 40% of all smartphone shipments on the continent over the last three months of the year were priced at $800 USD or higher. Canalys analyst Runar Bjørhovde said, “The dominance of the high-end was mainly fueled by strong iPhone 15 Pro demand alongside consistent Galaxy S-series volumes and a growing Google Pixel.”

The iPhone made up 77% of the fourth quarter shipments in the high-end segment of the European market followed by Samsung with 16% and Google with 4%.

The iPhone dominated Q4 shipments of high-end devices in Europe

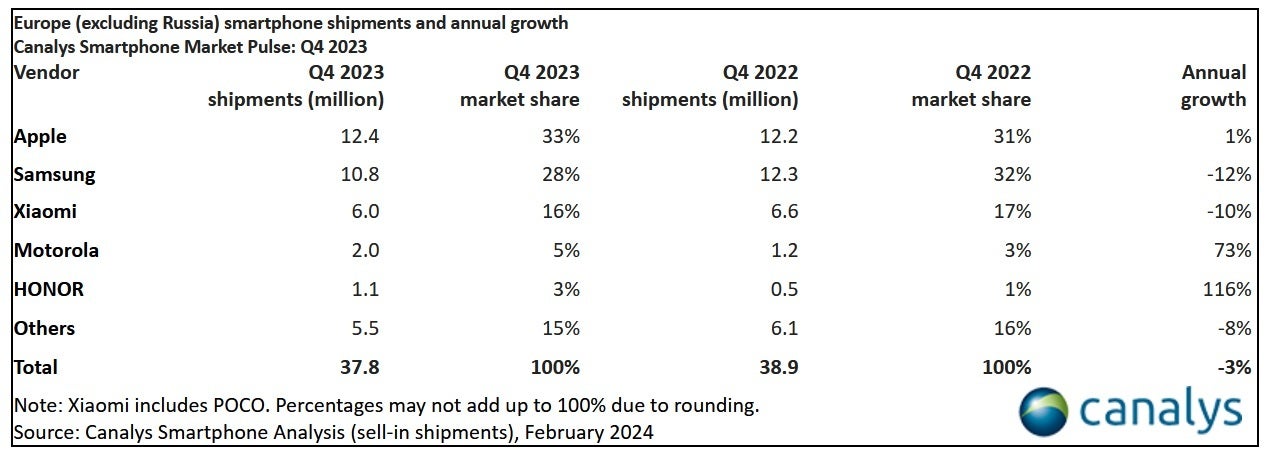

During the fourth quarter of 2023 in Europe, shipments of the iPhone 15 Pro and iPhone 15 Pro Max helped Apple take the top spot with 12.4 million iPhone units shipped. One out of every three smartphones delivered in Europe during Q4 was an iPhone model, up from the 31% share Apple had during the same quarter in 2022. From October through December 2023, Apple’s annual growth rate was 1%.

Apple takes the top spot among European smartphone manufacturers during the fourth quarter of 2023

Behind Apple in second place for the quarter was Samsung with 10.8 million units shipped, a 12% decline on an annual basis. Thanks to that drop in the number of phones it delivered in Europe from October through December, Samsung lost its lead to Apple as its market share fell from 32% during the last quarter of 2022 to 28% during the last quarter of 2023. Xiaomi was next having shipped 6 million units during the fourth quarter in Europe, 10% fewer than the 6.6 million delivered during the same quarter during the previous year. Xiaomi’s market share in Europe fell during the quarter from 17% to 16%.

Finishing fourth was surprising Motorola which saw shipments soar 73% to two million units during the three-months thanks to the foldable Razr 40 line. The Lenovo subsidiary captured 5% of the European smartphone market up from 3% the prior year. And rounding out the European top five for Q4 was Honor. More than doubling shipments in Q4 2023 (shipments were up 116%), Honor delivered 1.1 million handsets in the continent tripling its market share from 1% to 3%.

For the quarter, the total number of smartphone units shipped in Europe came to 37.8 million, down 3% from the 38.9 million that were delivered during the same quarter in 2022.

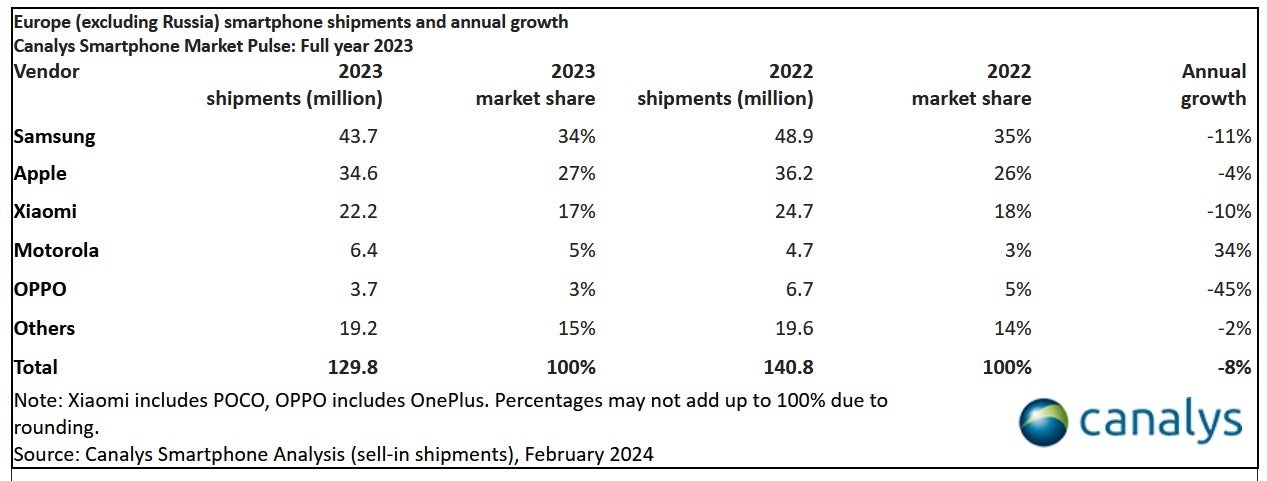

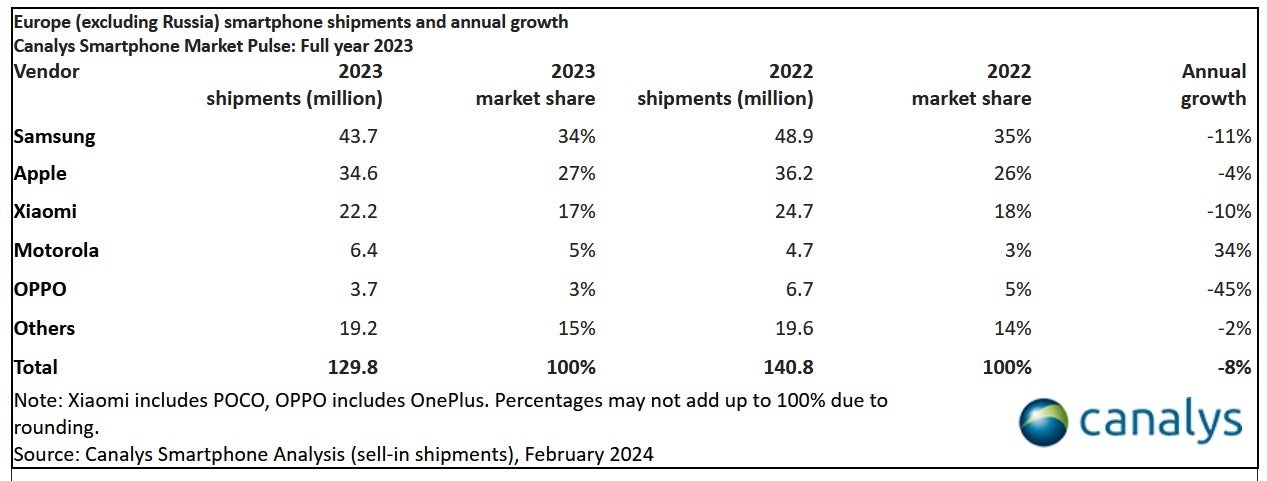

Samsung was the leading smartphone manufacturer in Europe for all of 2023

Samsung still had a big lead on Apple and took the top spot as the largest smartphone manufacturer in Europe for all of 2023. Sammy shipped 43.7 million units for the whole year which was down 11% from the previous year dropping the company’s European market share for 2023 from 35% to 34%.

With 34.6 million iPhone units delivered in Europe last year, Apple’s shipments fell 4% which still allowed the company to increase its market share in the continent to 27% from 26% year-over-year. Xiaomi finished third having shipped 22.2 million units in Europe, a 10% annual decline dropping its market share from 18% to 17%.

Motorola was the fourth largest smartphone shipper in Europe for 2023 having delivered 6.4 million units which was up 34% from the 4.7 million it shipped during 2022. Motorola’s 2023 European market share was 5% compared to 3% during 2022. And closing out the top 5 was Oppo which suffered a 45% decline in shipments for the year to 3.7 million handsets. Oppo’s European market share went from 5% in 2022 to 3% in 2023.

For all of 2023, 129.8 million smartphones were delivered in Europe, down 8% from the 140.8 million that were shipped in 2023.