After winning the global smartphone sales war for an entire year for the first time in history in 2023, Apple was unable to start 2024 on a similarly high note, giving back its crown to Samsung at the end of the first quarter.

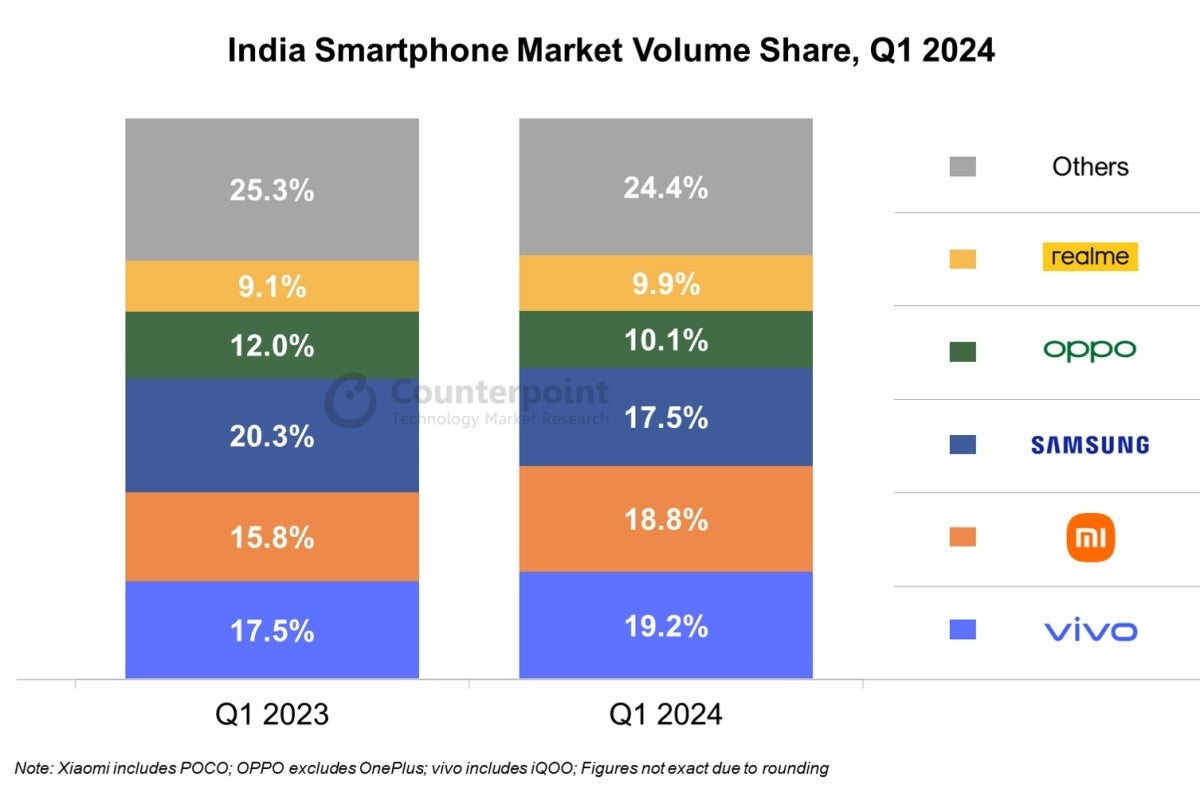

But because the mobile industry is very rarely a true black-and-white affair, there are various shades of gray surrounding both Samsung and Apple’s Q1 2024 results in key regions around the world. In India, for instance, one market research firm named Samsung the quarter’s volume champion a few weeks ago, while another one is only ranking the company in third place in the country today.

How bad is that result for Samsung?

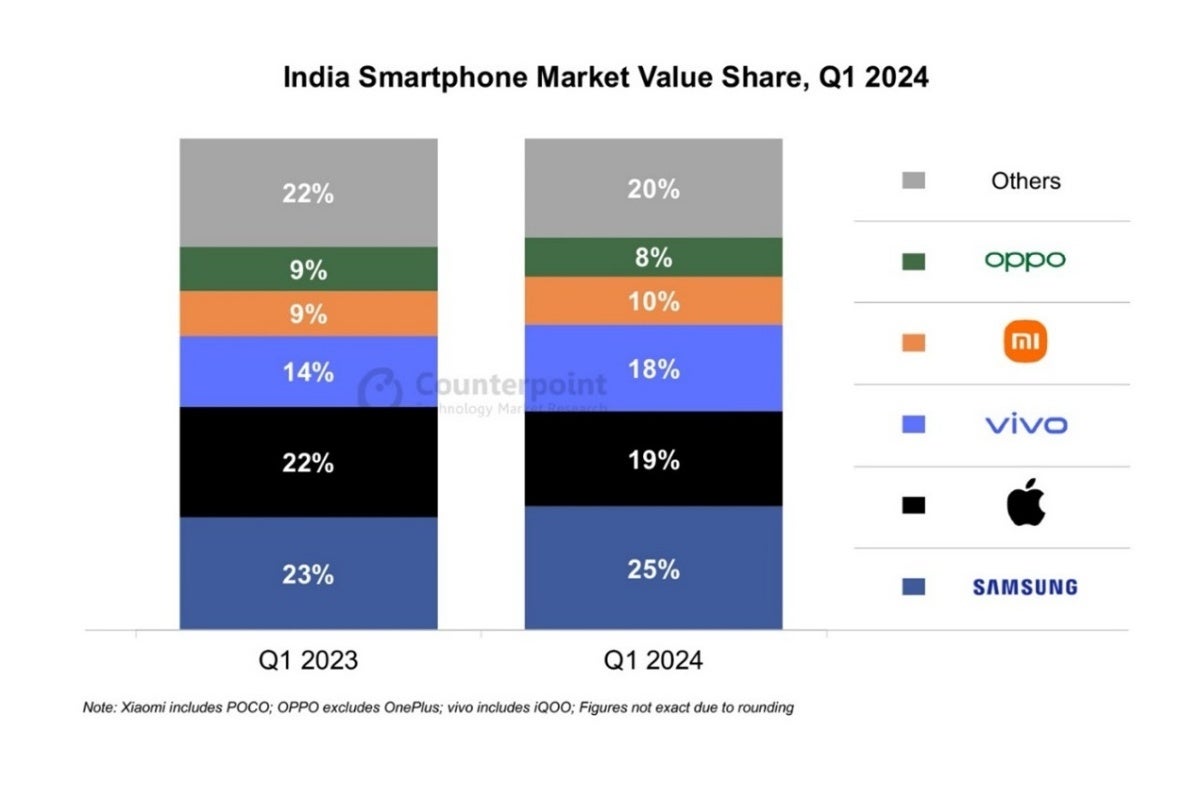

Not as bad as it sounds, mind you, as Samsung is still ranked first for value in India’s smartphone market between January and March 2024. That means the Korea-based giant sold the most valuable devices overall in the region in that period despite being eclipsed by Vivo and Xiaomi as far as the actual number of units is concerned.

Even better, Samsung will undoubtedly be delighted to see its value share boosted from 23 percent in Q1 2023 to 25 percent now… despite its volume share dropping from 20.3 to 17.5 percent in the same period.

What’s bizarre about the new Counterpoint Research charts is that they’re radically different from the data presented by Canalys in April for the same year-opening quarter. While one research firm puts Vivo above all other vendors, its rival sees Vivo barely make the podium.

Interestingly, Xiaomi is the silver medalist in both reports, at least as far as shipments are concerned. In terms of value, meanwhile, Apple follows Samsung with a 19 percent slice of the pie, narrowly beating Vivo and easily keeping Xiaomi and Oppo at a comfortable distance.

Curiously enough, Apple’s value share is somehow down from 22 to 19 percent while the iPhone 15 series is hailed as an absolute local blockbuster. The company’s Indian revenues are said to have set a new quarterly record, so that small decline can only be explained by other brands breaking their own records as well… by larger margins.

Clearly, premium phones are getting bigger and bigger in the country (in terms of mainstream popularity and not just screen size), generating important gains for the likes of OnePlus and Motorola in addition to Apple, Samsung, and Vivo.

What’s on the horizon?

In one word, growth. In two words, solid growth. In more words, “single-digit growth in 2024, driven by strong premiumization (that’s not a real word, is it?), 5G adoption, and post-COVID upgrades.” So, no, it’s probably not fair to expect explosive sales growth, but that “premiumization” trend means that profit margins and average prices will continue to go up for a lot of brands, and something tells us that most of these brands would rather see that happen than double-digit volume progress.

Samsung, for instance, has reached a new all-time high ASP (average selling price) of $425 for its smartphones in India, a number primarily boosted by the early success of the Galaxy S24 family and secondarily by the mid-range Galaxy A portfolio.

That’s obviously expected to jump even higher with the impending launch of the Galaxy Z Fold 6 and Z Flip 6, and the same could happen for the likes of Apple and OnePlus in the next few months as new high-end models either see daylight or continue to sell like hotcakes.

Believe it or not, the brand that grew the most in the region during the first three months of the year was Nothing, which is however still unlikely to rise to the local top five anytime soon. Motorola’s shipments also jumped by an incredible 58 percent, while Xiaomi, Transsion, and Realme’s numbers all made solid, Samsung and Apple-beating progress of their own. In short, India remains a very crowded and massively competitive market where all kinds of different companies are engaged in a fierce battle for supremacy and growth.